Polymarket Up and Down Algo & Bot

✅ AI-Trained Strategy – Built on machine learning models trained daily with 74+ BTC indicators for maximum accuracy.

✅ Automated 24/7 Trading – The bot trades continuously using Polymarket's API, including overnight sessions with the best historical performance.

✅ Fixed-Risk, Predictable Outcome – Binary market structure ($0 or $1) limits your downside while maximizing upside potential.

✅ Dual-Timeframe Execution – Uses both 60-minute and 15-minute models to capture short-term moves and longer-term trends.

✅ Ultra-Low Fees – Trades are executed using USDT with minimal to no fees, enabling fast entry, exit, and liquidation.

✅ Smart Liquidation Bot – Minimizes losses by liquidating low-probability positions before full devaluation, preserving capital.

✅ Web-Based Control Panel – Easily set risk levels, activate/deactivate the bot, and track performance in a simple online dashboard.

✅ Backtested, Real-Market Proven – Strategy and bot performance are based on rigorous backtests and ongoing live trade data.

✅ Free Demo Access – Test the live dashboard and see real trades in action.

FAQ Polymarket Bitcoin Up and Down Algo & Bot

Why Polymarket Bitcoin Up and Down instead of trading Bitcoin directly?

Frankly, this market was a perfect fit for us. We had a lot of previous experience with our prediction model for Futures using ES, which estimates the probability of each hourly candle's close.

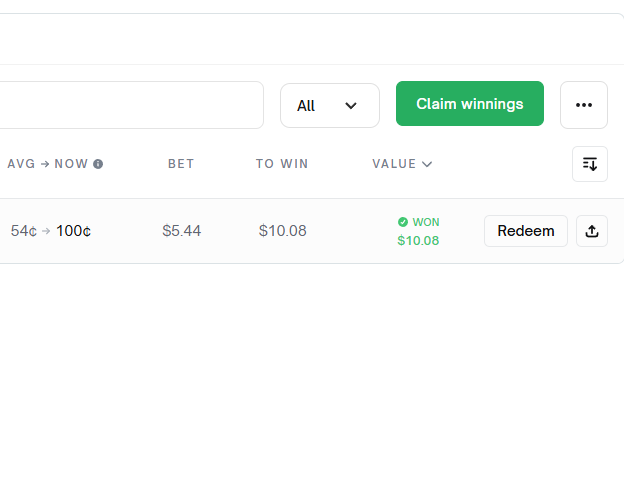

One of the main advantages of using Polymarket's Bitcoin Up and Down is the limited risk — the bets (or rather, the trades we place) have a fixed risk and a predictable outcome: $0 or $1.

When we ran the numbers through our model, we quickly realized that the math strongly favors us — we have a winning model and strategy.

Another major advantage is that Bitcoin Up or Down offers 24-hour trading. By using Polymarket's API, our bot operates 24/7. And since we use USDT (crypto), there are practically no fees, or they are extremely low. This allows us to enter, exit, liquidate, and have the bot squeeze the most out of the market.

What is Polymarket Up and Down?

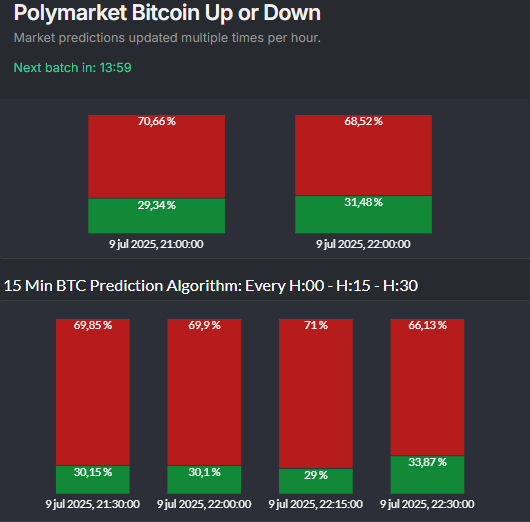

Polymarket is a binary prediction market. In our case, we utilize the continuous "Bitcoin Up or Down" event. If the closing candle of the event is green, "Yes" is the winner. If the closing candle is red, "No" is the winner. Polymarket uses the Binance USDT ticker to determine this, and you can follow the same ticker for ease. Our AI-ML algorithm predicts the probability of each event every hour and 15 minutes, and the bot executes orders via API based on this model. See a live event here. Make sure to choose today date

How do the Bot and the strategy work?

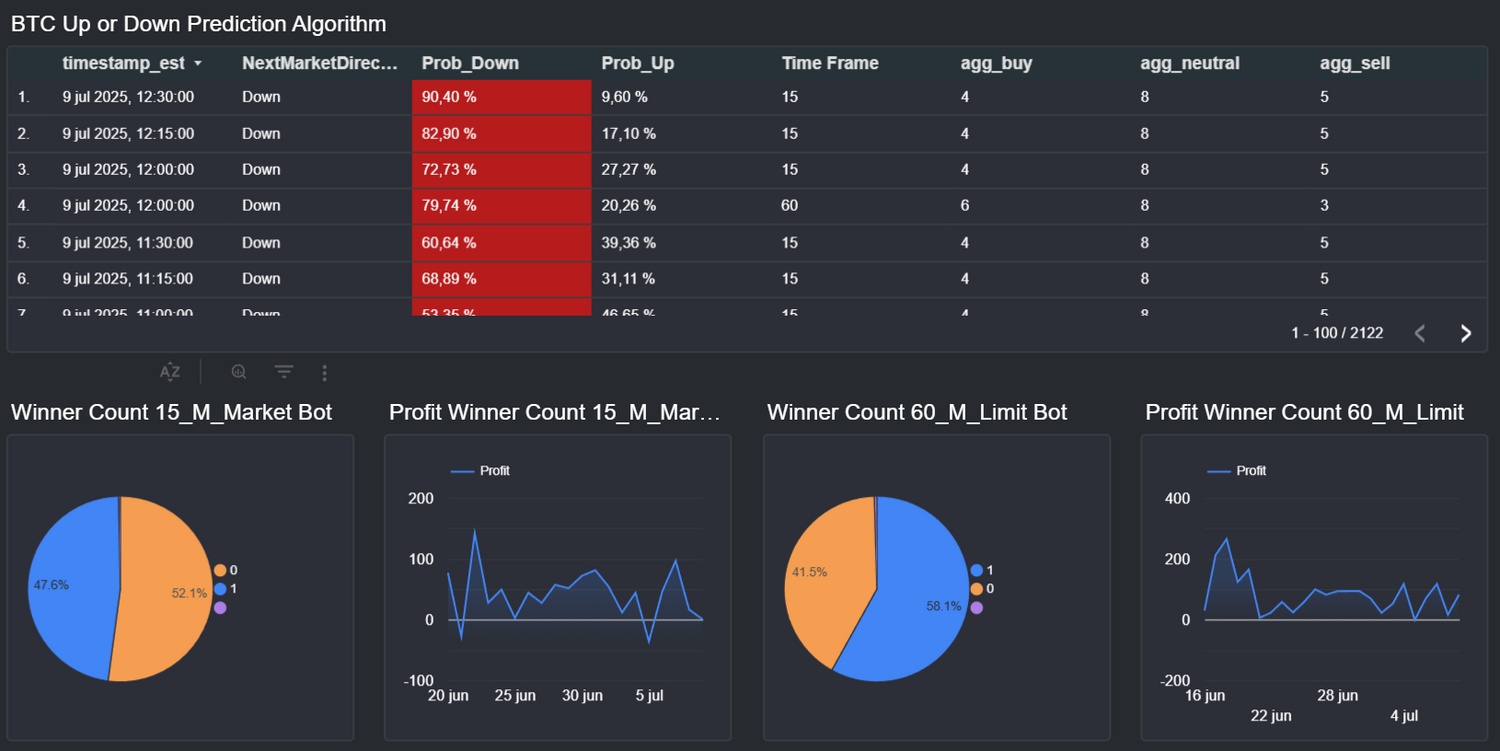

The bot operates based on two models: 60-minute and 15-minute. It enters positions at the top of the hour, and at 15 and 30 minutes past the hour. The 60-minute bot seeks a favorable price using Limit (LMT) orders, while the 15-minute bot enters positions using market orders.

Where do I control the Bot?

Everything works through our web-based control panel. There, you can set your risk level, activate or deactivate the bot, and track your results.

How do the prediction models work?

The strategy operates based on two ML-AI models that make probability predictions regarding direction. One model is for 60 minutes, and the other is for 15 minutes. We use a Boosted Tree classifier and regressor algorithm. The model is trained daily with over 74 BTC indicators.

Which data source determines de winner resolution?

Polymarket uses the Binance USDT ticker to determine the resolution, specifically based on the hourly close. We use the same data source for training the models and making the predictions that the bot will use to triger trades.

How much should I fund my account?

Can I hold "Buy Yes" and "Buy No" positions simultaneously?

Is there a stop loss?

How do I get a Wallet id and Key?

To be able to get a Wallet id and Key from Polymarket you need to create an account using email. You can read this step by step guide: https://andywallsq.com/pages/polymarket-guide.

Which Countries Polymarket is banned?

- United States

- France

- Singapore

- Switzerland

- Poland

- Belgium

- Taiwan

- Thailand

Can I use a VPN if Im on one of those countries?

Some members efficiently use VPN in restricted countries. Just make sure to create and acocunt using an email address, our bot uses a server cluster from allowed jurisdictions, trades are placed using Polymarket API. Moving Funds is also straight foward.

Where can I test it?

You can signup in our free Dashboard and See Live Data and Trades. Signup here: https://andywallsqdashboard.com

Our BTC binary Algo can help you with two things:

1 Have an Edge

2 Control Risk

AI-Powered Trading: Real-Time Market Predictions for Smarter Trading

-

Stay Ahead of the Market with Machine Learning

Unlock the power of AI-driven market predictions and transform your trading strategy with real-time insights.

Our Machine Learning models analyzes market conditions every hour and every 15 minutes, providing high-probability trade signals that eliminate lagging indicators and optimize your entries.

-

Real-time learning keeps the model aligned with market fluctuations.

Traditional trading strategies rely on predefined technical indicators such as RSI, VWAP, volume and a gazillion more to determine entry and exit points. These rules-based approaches often suffer from lagging indicators, meaning they react to past price movements rather than predicting the market's next move. However, with the advent of Machine Learning (ML) models and AI, traders can now leverage real-time probabilistic predictions to anticipate market movements rather than relying solely on historical conditions.

.

This shift from discretionary and rule-based trading to data-driven ML strategies is revolutionizing financial markets, offering traders a systematic, adaptable, and forward-looking approach to decision-making.

Clear trade signals

When both the directional classifier Model and the price target regressor Model align, we classify the trade as High Confidence—a signal you should pay close attention to!

Trade Dashboard

We offer 2 dashboards:

Trade Signals Dashboard with clear trade signals and actionable forecasts.

Trade Results Dashboard

100% Designed for Polymarket

Automate your trading with the included 24/7 Bot. Achive +5% Profitability with the Number one winning strategy for Polymarket BTC up or down.

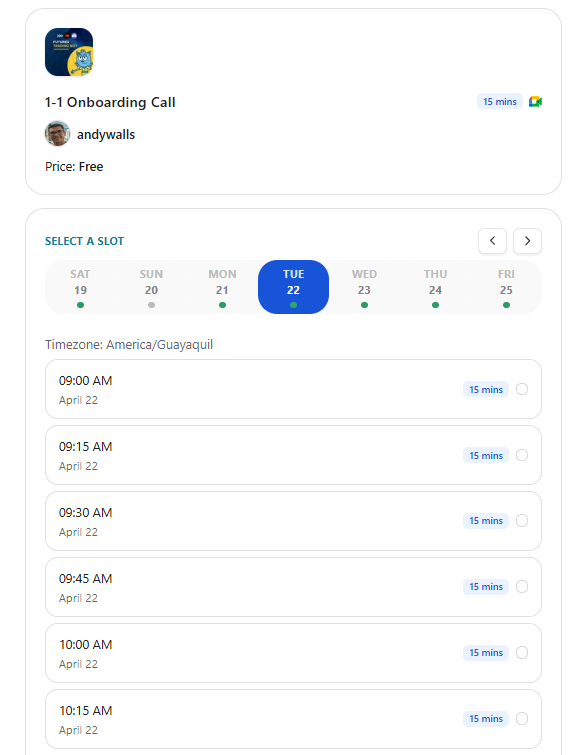

1-1 Onboarding

Schedule free one-on-one calls through our whop application. Find an available slot in the calendar and book a call.